For centuries, the biggest goal of science was alchemy — to turn lead into gold. It turns out this is actually possible in nuclear physics and is called transmutation. Bombard mercury with neutrons in a nuclear reactor or particle accelerator…and presto! Gold.

Today, thanks to AI, we are witnessing potentially the greatest transmutation in history. Software becomes labor. It’s the new E=MC2. Capital buys coffee, engineers, and GPUs. Out comes code that takes the role of labor. This will both grow existing software markets and create many new software markets where “per seat” pricing never allowed for a large outcome.

Historically, much of software digitized an offline form of storage, put it in a database, and then provided an accessible, permissionable front-end for the end-user who likely did not know SQL, with the speed benefits of a digitized, networked medium.

PeopleSoft and then Workday digitized the HR filing cabinet.

Zendesk digitized old-fashioned support “tickets.”

Quicken and Quickbooks digitized old-fashioned ledgers.

Epic and Cerner digitized health records.

Salesforce digitized the Rolodex and the chalkboard pipeline.

E-mail digitized, well, mail!

Instead of having Bill the HR clerk or Sally the accounting clerk literally “fetch” the files from the filing cabinet, William and Sarah in IT now exist to make sure that everyone in HR or accounting is properly provisioned and has access to the system. But accounting headcount and HR headcount is…the same.

But now — and this is the big change — the “users” of the digitized filing cabinet do not have to be humans.

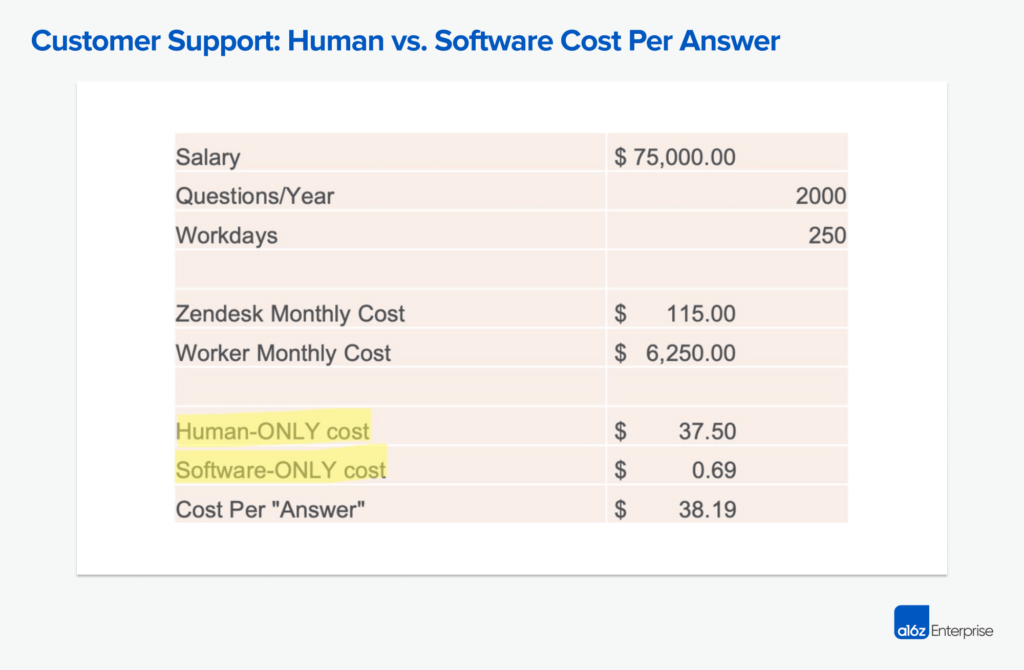

Let’s look at Zendesk’s pricing:

There’s a giant opportunity right now for all of the “digitized filing cabinet” companies — Intuit, Workday, Zendesk, etc. — to now charge for “quasi humans” to replace or augment the humans who accessed and acted upon the records in the past. This will likely necessitate large-scale changes to historical “per-seat” pricing models, since a business will need fewer (if any!) seats as the system…takes actions on its own, or even empowers humans to be 10x more productive.

Workday could charge for HR conversations. Intuit could charge for sending out collections letters for overdue receivables. Epic could charge for a post-appointment check-in. Salesforce could charge for, well, selling.

To be clear, this does not mean the end of white-collar work – if anything, AI will likely create new “AI jobs” that just weren’t possible with human costs or intermittent demand. There’s a popular saying in economics: “The cure for high prices, is high prices.” Meaning: as the price of an item goes up, more manufacturers decide to produce it (or existing manufacturers produce more), therefore increasing the supply, therefore decreasing the price. In the case of skilled labor, though, there’s simply too much latency. If nurses were paid 5x more tomorrow, it might not appreciably change tomorrow’s supply at all (maybe some retired nurses would un-retire!), but it would likely cause more to enter nursing school and graduate in 3 years. 3 years. What if a surge of nurses are needed…tomorrow?

For other professions, the training is “on the job” and it’s simply impossible to align the training time with the ebbs and flows of the business. Mortgage rates went down in 2021, creating a surge of demand for mortgage brokers…which ended suddenly as rates went up. Delta Airlines likely needed tens of thousands of trained support reps in the wake of the Crowdstrike disaster. The fifth fastest-growing job in the U.S. over the past 20 years is “compliance officer” where, again, training (and not just wages!) create shortages. AI will always show up to work, can be trained instantly, and will happily fill the “market void” caused when there is only intermittent or episodic demand for highly skilled work. Why go to school or learn something for years if your skill is only needed twice a year? AI does not have this problem.

From a venture capital lens, where almost every company has a compelling “Why Now” (if it was such a good idea, why didn’t it work before?), I’d like to think there have been three eras of cloud software:

- The Original Cloud Era (~1999-2007), when markets were big enough for pure software, largely displacing on-premise software. This is when players like Salesforce, NetSuite, Veeva, Hubspot, etc. emerged.

- The Financial Services-Enabled Cloud Era (~2010-Present), when markets became big enough with embedded payments, lending, and other “fintech” add-ons. For example, the software market for restaurants was small, but the “software + payments” market for restaurants is big — hence Toast (founded in 2012). The software market for HVAC contractors was small, but the “software + payments” market is big — hence ServiceTitan (founded in 2012), etc.

- The “AI-Enabled Outcomes” Cloud Era (Present – ), when the software market was small because labor is the primary cost and the software need — the digital filing cabinet — was relatively small or generic. The software provider for many professions is just Excel and Word, versus specialized tools.

This isn’t to say that the only AI successes will be “net-new” categories. But as is often the case, in the battle of distribution vs. innovation, distribution is the default winner — and existing software companies have distribution. Particularly now, in 2024, when AI is the top priority for virtually every software company and end customer. In 2007, most CEOs thought the iPhone was stupid (no keyboard!) and Blackberry was better. In 1996, most retail CEOs thought that the internet was a toy, a fad, and surely people wouldn’t buy things from a web browser. That allowed new companies to fill this void. In 2024, it is almost impossible to find a CEO who thinks AI is a bad idea.

There will effectively be three kinds of origins and outcomes for AI software companies:

- AI tools that run on top of existing software (think: automatic meeting notes for Zoom meetings)

- AI tools that run on top of existing software that have a shot of displacing that existing software (think: meeting notes for Zoom Meetings…where said company then builds video conferencing and pitches you to ditch Zoom)

- AI tools that turn into labor — a net-new category, completely untouched by software until this point (think: the software conducts the meeting for you!)

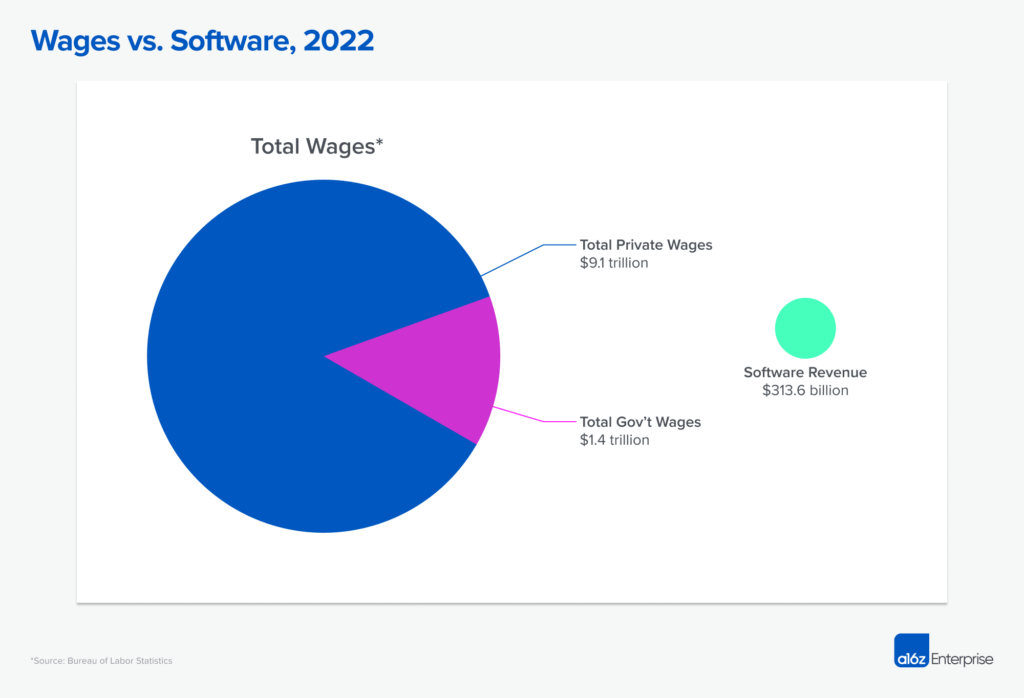

Platform shifts have always enabled the first two (internet versions of X, mobile versions of X, cloud versions of X). But what is most exciting about the AI revolution is that the enterprise software market — which looks big at $300B/year in spend — is infinitesimal compared to the white-collar labor market, at many, many trillions of dollars a year. It’s why many of the fastest-growing companies we are seeing have been the “known unknowns” of taking existing expensive services, and delivering low-price point products (created by AI) to the masses.

And we are in the very first inning of software eating – and augmenting – labor.